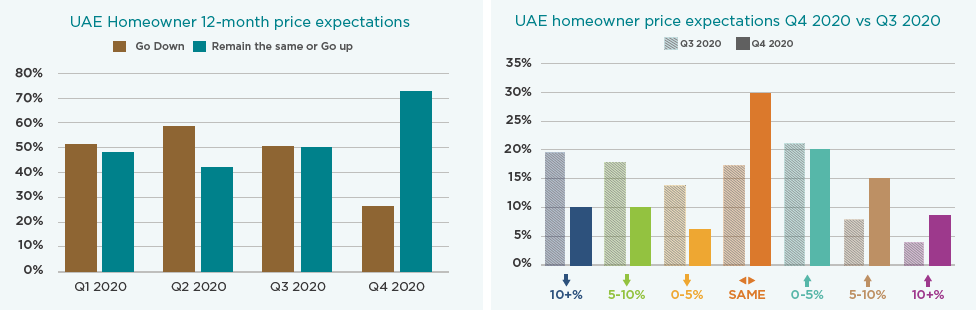

With more respondents (53% versus 47%) expecting prices and rents to be stable or go up in the next 12 months. This is a sharp turnaround from October 2020, when only 31% of respondents expected prices and rents either to be stable or rise.

|

| The residential real estate market in both Abu Dhabi and Dubai was very weak in 2020, with apartment rents in Dubai declining by over 15%, and sales prices falling by as much as 10%. Since the peak of the cycle, both rents and sales prices have roughly halved. With sentiment now turning, 2021 may be the first year since 2014 during which the market strengthens.

For the first time since Q1 2020, when we began conducting our sentiment survey, the majority of respondents do not now expect prices and rents to fall in the coming 12 months. |

|

| Comparing Q4 with Q3 2020, the percentage of respondents expecting prices and rents to go down by 10% or more has fallen by 12 percentage points, from 28% to 15%. Counterbalancing that, the percentage of respondents that now believe prices and rents will remain the same in the next 12 months has increased by 14 points, from 16% to 31%. ‘Remain the same’ is, by some margin, the most common response, making up 31% of total responses. |  |

Only 27% of respondents expect prices to continue to decline, with 30% expecting price stability. The largest group, 43%, expect prices to rise in the coming 12 months.

This marks a hugely significant improvement in sentiment. In Q1 and Q2 2020, the majority of homeowners expected price declines over the following 12 months. At the end of Q3 2020, responses were split 50/50. The large positive skew is also clearly demonstrated in the contrast between Q4 and Q3 2020.

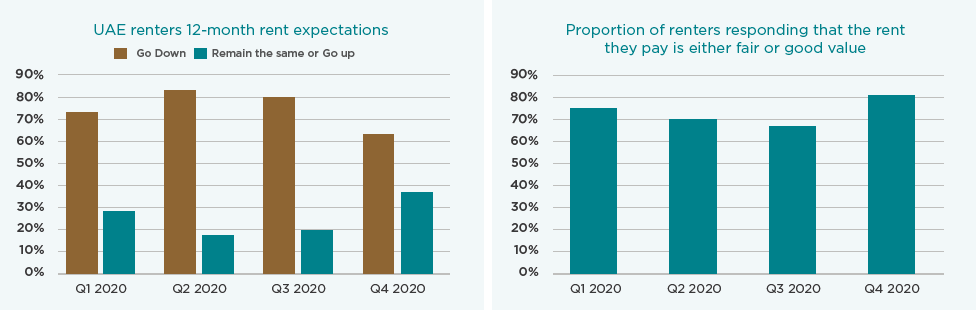

65% of renters sill expect rents to decline, but that’s down from 80% at the end of Q3 2020.

Throughout the last 12 months, a majority of renters have considered the rent they pay to be fair or good value. With further rent declines during 2020, this proportion has now risen to 81% of respondents.

A Home Sentiment Survey measures consumer sentiment towards the residential property market. It allows for the creation of an index, which is derived from regular surveys of a representative sample of homeowners and renters. The survey can determine sentiment regarding buying, selling, investing in, renting of and renovating property, as well as property market conditions in general.

Survey findings are useful in informing a variety of decisions made by stakeholders: from developers, government authorities, individual buyers, renters and investors.

ABOUT PENINSULA REAL ESTATE AND OUR PARTNERSPENINSULA is an investment and research company that is identifying trends, opportunities and challenges in the MENA real estate market. ELTIZAM ASSET MANAGEMENT GROUP (Eltizam)is a leading physical asset management company based in the UAE, with an expanding presence across the GCC and MENA regions. Through its group companies, Eltizam provides best-in-class services for the built environment (residential, commercial, retail, industrial and infrastructure asset classes) supporting asset owners to maximize long term returns on assets. CBRE GROUP, INC. is the world’s largest commercial real estate services and investment firm (based on 2019 revenue). CBRE o ers a broad range of integrated services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. CITYSCAPE INTELLIGENCE, part of Cityscape the world leading global real estate event series, is a brand new content hub that connects the industry to global real estate news and market intelligence. BERKSHIRE HATHAWAY HOMESERVICES GULF PROPERTIES is the regions premier real estate agency providing expert advice and support to our clients, across many key real estate markets across the world. |

This report has been issued by Peninsula Real Estate Management Limited (“Peninsula”) for informational purposes only. It does not purport to be a complete analysis of the topics discussed, which are inherently unpredictable. It has been based on information collected from raw data sources, which Peninsula believes to be reliable. Peninsula has not independently verified those sources and makes no guarantee, representation or warranty as to its accuracy or completeness. The data published in this report is based on responses that we received to a questionnaire sent out by Peninsula during March 2020 and more widely distributed through our partners Eltizam, CBRE, Cityscape and Berkshire Hathaway Home Services. The raw data has not been amended, weighted or seasonally adjusted; we do not, therefore, claim the findings to be statistically significant; nor, as a result, can we guarantee that they accurately reflect real estate sentiment in the MENA region. The sentiment measures published in this report should not be assumed to be accurate predictions of future property market performance. Peninsula accepts no responsibility or liability in respect thereof or for any reliance placed by any person on such information. All opinions and views expressed in the report reflect our judgment at this date and are subject to change without notice. Statements that are forward-looking involve known and unknown risks and uncertainties that may cause future realities to be materially different from those implied by such forward-looking statements. No investment or other business decisions should be made based on the views expressed in this report. This document may not be reproduced or circulated without the prior written consent of Peninsula.

Peninsula PLC today announced a new strategic investment by Fortinbras Enterprises, via its affiliate fund, to support the company’s growth and deepen its impact on the commercial real estate market in Abu Dhabi, the UAE, and GCC. Peninsula Real Estate, founded in 2019 in Abu Dhabi and incorporated in the Abu Dhabi Global Market, is […]

Peninsula is delighted to announce newly appointed members to its Board of Directors Peninsula’s Board of Directors demonstrates the Company’s commitment to best-in-class governance standards and enhances Peninsula’s deep in-market expertise and extensive global real estate knowledge. Peninsula’s Board of Directors now consists of 7 members, of which 2 are the existing Executive Directors and […]

Operation 300bn is set to be a game changer in transforming the UAE’s manufacturing sector into a global powerhouse. The 10-year industrial strategy announced last year by the UAE government seeks to more than double the GDP share of the manufacturing sector from AED 133 billion to AED 300 billion by 2031. The bold initiative includes the ‘Make It In The Emirates’ campaign to expand the UAE’s manufacturing base by encouraging local and international investors to manufacture in the UAE – this is further supported by the National In-Country Value (ICV) Program, which aims to boost local demand for locally produced goods and services.